A Newer Version of the paper is at Measuring Slavery in 2020 Dollars.

by

Samuel H. Williamson

MeasuringWorth

University of Illinois at Chicago

sam@mswth.org

and

Louis P. Cain

Loyola University Chicago

Northwestern University

lcain@northwestern.edu

Slavery was an ancient practice on the North American continent. In relation to the colonies that became the United States, it first appeared in Virginia in 1619. It was legal in all the British colonies, but it was practiced on a larger scale in what became the US South and the British Islands of the Caribbean. Northern farms were generally smaller, family-sized plots of land with the family supplying most of the labor. African slavery was largely a response to the greater demand for labor on Southern tobacco, rice, and indigo plantations. Before the American Revolution, there was no significant movement for abolition. By the early 1800s, most Northern states had passed laws in favor of abolition, but the acts called for gradual abolition.

In the South, on the other hand, slavery became an ingrained economic and legal institution. Slaves and their progeny were the property of an owner, and slaves were owned until they died. They could be bought and sold and their owners controlled their lives and those of their children. When slaves were sold, the contract was a legal document, even to the extent that a buyer could sue the seller if a slave was sold under false pretenses. Even slaves themselves had some protection under the law-- they could not be abandoned or executed.

Before independence, the laws of the colonies could not be repugnant to English law. Chief Justice Lord William Mansfield in the Somersett case (heard in London in 1772) held that English law did not support slavery, a ruling that eventually led to the peaceful extinction of African slavery in the British Empire. By then, the Americans were on a different path. In the Constitutional Convention discussions of 1787, it was held that slavery was not a moral issue but a matter of "interest" only. Some delegates believed that slavery was going to die out. Virginia had attempted several times unilaterally to end the slave trade to Virginia ports, but the Board of Trade lawyers in London had overruled it. The federal government prohibited the trade in slaves beginning in 1808, but statesmanship and jurisprudence could not find a way to end the institution. Within a decade of the Constitutional Convention, Eli Whitney's cotton gin appeared, which is popularly credited with sparking an explosion in cotton production in the South. This may be partly true, but an additional explanation is that the technological improvements in spinning and weaving in England created a big increase in the demand for cotton, a cloth much preferred to wool. These events reenergized the demand for slaves.

Slavery is a subject that most Americans have confronted as part of their education, but there are many dimensions of slavery that have been left to the dim mists of history. This paper will review some of the basic dimensions of the economics of slavery in the United States and put them in perspective by showing what the financial magnitudes of the "peculiar institution" might be in the relative prices of today. In particular, in 1860 there were nearly four million slaves and their average market value was around $800, but what does that mean?1 How much would that be in today's dollars? Answers to such questions are not simple.

Comments posted to MeasuringWorth (see the appendix) indicate there is considerable current public interest -- and public confusion -- in regard to such questions. Our intention is to present, for the first time, macroeconomic and microeconomic dimensions of slavery in values measured by today's dollars. We are addressing two audiences: the public who know relatively little about these dimensions and the specialists who may have forgotten that the relative magnitude of these dimensions would be conservatively described as large.

Why does anything have value?

A monetary value can be measured by a transaction when something is bought and sold, or as an expected value of an asset currently held. Some assets have value because of the potential income they can generate. An example would be a piece of capital equipment such as a cotton gin for which planters would pay to have their cotton processed, or a slave who would pick the cotton.

Other assets may have value because of their potential resale value, such as land or a rare painting. The owners of a painting choose to have part of wealth invested in something that does not generate current income, either because of an expectation that it will appreciate or because they wish to "consume" the pleasure of owning it. These assets also may give their owner status and power. Owning a Rembrandt painting gives one bragging rights among art collectors. Owning half the acres in the county gives one lots of influence in local politics, regardless whether the acres are in production or not.

What is the motivation for owning a slave;

what determines the price of a slave at a given point in time?

The demand for a slave is a derived demand, as is that for any productive resource. It is derived from the demand for the output that resource helps to produce. There was an active market for slaves throughout the antebellum period meaning that slave owners believed the purchase of a slave would prove to be a profitable expenditure, even though that expenditure required a considerable amount of money2. As we will explain below, at the time the South seceded from the Union, the purchase of a single slave represented as much as $130,000 and more in today's prices. This was twice the average of 14 years earlier, indicating a sustained growth in the demand for slaves. Economists would say that these observations alone indicate that the profitability of "investing" in a slave was increasing substantially.

Why would a slave have so much value? A short answer is the value of a slave is the value of the expected output or services the slave can generate minus the costs of maintaining that person (i.e., food, clothing, shelter, etc.) over his or her lifetime3. A quick list of the things that have to be considered in determining the value of a slave's expected revenue would include sex, age, location, how much he or she is likely to produce (a factor that included a slave's health and physical condition), and the price of the output in the market. For a female slave, an additional thing to consider would be the value of the children she might bear.

In addition, there is considerable evidence that slaves were worked harder than free labor in Southern agriculture, that what they could be induced to produce in bondage was greater than what they could be expected to produce with the freedom to make their own choice of labor or leisure.4

As these outputs and costs are in the future, they must be discounted to their present value so an owner must choose a discount rate. And, as they are in the future, there is uncertainty in determining what they are, and the present value of a slave is an estimate of the current owner5. In general, most economic historians believe that slavery was profitable, even at these expensive prices.

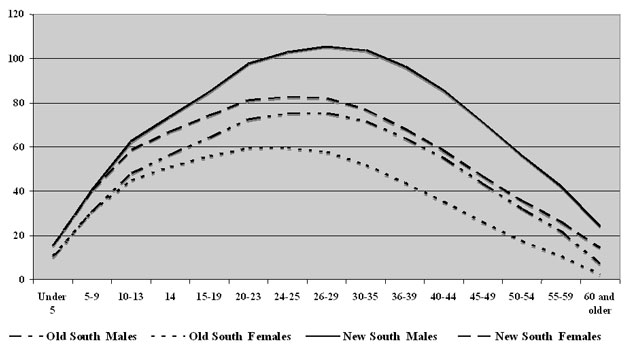

Figure 1 demonstrates how the price of slaves varied with respect to age, sex, and location during the antebellum period. As can be seen, prices were higher in the New South than in the Old South (the states along the Atlantic coast) and higher for males than for females6. The statistics on slave prices show that healthy young adult men in the prime of their working lives had the highest price followed by females in the childbearing years. Young adult males had more value as they were stronger, could work harder in the fields, and could be expected to work at such a level for more years. Young adult women had value over and above their ability to work in the fields; they were able to have children who by law were also slaves of the owner of the mother. Old and infirm slaves had low, even "negative," prices because their maintenance costs were potentially higher than the value of their production. Similarly, young children had low prices because the "cost" of raising them usually exceeded their annual production until they became teenagers.

Figure 1

Age-Sex Profile of Slave Values

Louisiana Male 18-30 = 100

Source: Source: Historical Statistics, Table Bb215-218. Index of slave values, by age, sex, and region: 1850. All the values are indexed to that of Louisiana males aged 18-30.

Those who have researched slave prices have discovered that a large number of additional variables went into the determination of the price of any particular slave at a particular point in time. A premium was paid if the slave was an artisan -- particularly a blacksmith (+55%), a carpenter (+45%), a cook (+20%), or possessed other domestic skills (+15%). On the other hand, a slave's price was discounted if the person was known to be a runaway (-60%), was crippled (-60%), had a vice such as drinking (-50%), or was physically impaired (-30%). In general, the discount for each of the slaves was slightly larger for females than for males7. The prices presented above are average prices for the slaves transacted in a given year. A person studying their family's history might come across a notation that a family member purchased a slave at a given price or that a family member purchased their freedom at a given price. Without information on these details, it is difficult to interpret what the price of a single slave means.

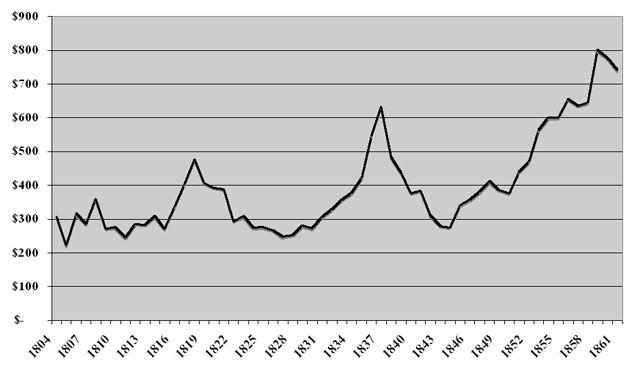

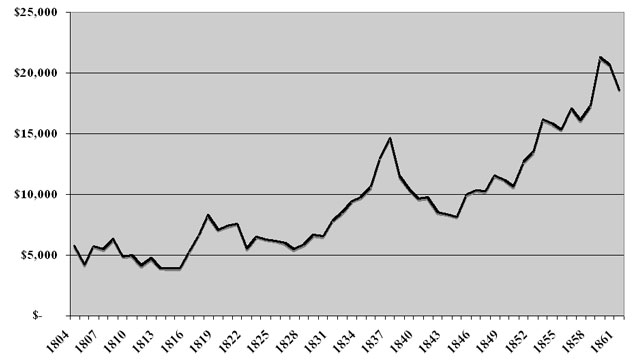

The path of the average of slave prices can be seen in Figure 2. While much of the movement can be explained by what is happening in the cotton market, the first two spikes are also related to general economic conditions. During and after the War of 1812 there was a 40% increase in all prices with the price of raw cotton more than double during the same period. In the 1830s, the price of slaves increased quickly due to expectations bred by discussions to refund the federal budget surplus to the states. Discussions about "internal improvements" (e.g., canals and railroads) led to a boom in land prices and, once again, cotton prices. After the "Panic of 1837" there was a long depression. Finally the almost three-fold increase in prices after 1843 can be explained by several factors including the rapid increase in the worldwide demand for cotton and increased productivity in the New South attributable to better soil and improvements in the cotton plant. It is clear during this time that the market for slaves was active and they were being regarded as more valuable.

Figure 2

Average Price of a Slave Over Time

Current dollars

Source: Historical Statistics, Table Bb212. Average Slave Price.

What is the comparable "value" of a slave in today's prices?

None of these prices has much meaning to us today, but they would if we revalue them in today's dollars to the amount of money slave owners spent 150 years ago8. The techniques developed in MeasuringWorth have created ten "measures" to use to compare a monetary value in one period to one in another as explained in the essay "Measures of Worth."9 Of those ten, three are useful for discussing the value of a slave. They are: labor or income value, economic status and real price10. Using these measures, the value in 2009 of $500 in 1850 (the average price of a slave that year) ranges from $11,000 to $162,000 thousand.

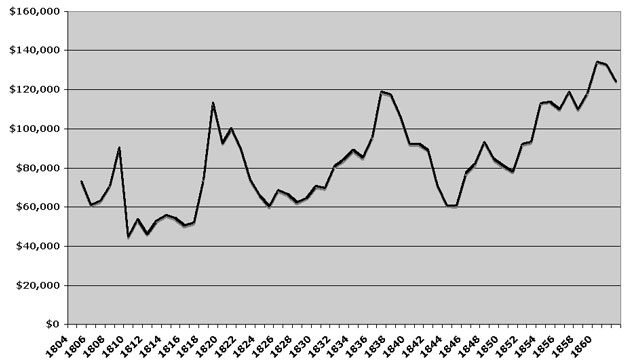

Labor or Income Value

Figure 3

Labor Income Value

of Owning a Slave in 2009 Prices

As discussed above, the $500 price in 1850 represents the expected net value of the future labor services a slave would provide. This is why the labor or income value is the correct measure of the value of a slave's services in today's prices. That $500 would be $78,000 in today's prices.

While some slaves were rented out for farm and other types of work, most slaves worked on the farms and plantations of their owners. In both cases, the work they did was mostly unskilled, so a comparable measure of these services would be the unskilled wage11. In other words, we can assume that to hire someone to do the work of a slave would cost the unskilled wage of that day. Thus, a measure of the average value of a slave would be the present value of the net rental cost over the life expectancy of the average slave.

Thus the value in today's dollars of a slave during the antebellum period ranges from $45,000 (in 1809) to $134,000 of a slave's expected revenue less maintenance costs. If we assume, for example, that the average slave will live 20 more years, then today's price for a slave valued at $500 in 1850 could be interpreted as the $78,000 in wages plus the 20 years of room, board, and clothing that it would take to hire unskilled workers today to perform the lifetime services expected of a slave12. Unlike hired hands, slaves were responsible in large part for producing their own room, board, and clothing. Given the work week today is significantly shorter than in 1850 and that slaves were made to work harder during the same amount of time as free workers, it would take more than one hired hand today to replace the labor supplied by a slave then.

Even at these prices, some slaves, particularly those with artisan skills, might ultimately earn enough to buy themselves out of slavery. It was not uncommon, especially in the Old South, for masters to allow others to hire the services of his or her slaves. This was particularly true of slaves who lived in urban areas, independent of the master. They were expected to make their own arrangements. "The master fixed the wage that the slave must bring in. All above this amount the slave might keep himself. - employers frequently hired the slave's time from the owner at a certain amount and paid the slave an additional wage contingent on amount of work accomplished."13

Figure 4

Economic Status

of Owning a Slave in 2009 Prices

The Economic Status.

The $500 average slave price in 1850 can also be thought of as a signaling device of status in a period where the annual per capita income was about $130. Economic status can be viewed as the ability to purchase expensive goods. Today, the middle and upper-middle classes aspire to goods and services such as a second home, servants, and an expensive car as a way of showing others that they have "arrived," that they have achieved some status in the economy. The average slave price in 1850 was roughly equal to the average price of a house, so the purchase of even one slave would have given the purchaser some status. Comparisons based on economic status are measured by the relative ratio of GDP per capita. Consequently $500 in those days corresponds to nearly $200,000 in economic status today.14

Figure 5

The Real Price of Owning a Slave

in 2009 Dollars

Real Price

Economists commonly use the real price measure when they are trying to account for the impact of inflation. The real price today is computed by multiplying the value in the past by the increase in the consumer price index (CPI). The result compares that past value to a ratio of the cost of a fixed bundle of goods and services the average consumer buys in each of the two years. In the construction of the CPI bundle, an effort is made to compensate for quality changes in the mix of the bundle over time.15 Still, the longer the time span, the less consistent the comparison. In the 19th century, there were no national surveys to figure out what the average consumer bought. The earliest budget study used by economic historians was of 397 workmen's families in Massachusetts and was constructed in 1875. These families spent over half their income on food and rented their housing.16

The MeasuringWorth calculator shows that the "real price" of $500 in 1850 would be approximately $12,000 in 2009 prices. We all can identify with what that amount of money would buy today, but hardly anything we would spend $12,000 on today was available 160 years ago. $500 in 1850 would have purchased 6,000 pounds of bacon, 3,800 pounds of coffee, 2,000 pounds of butter, or 1,200 gallons of gin. It is unlikely, however, that this was the budget of the typical slave owner. Most of the food would be produced on the plantation, and housing would have been buildings constructed by the owner (and his slaves). The "opportunity cost" of the $500 for the slave owner would have been supplies for the plantation or perhaps luxuries and travel.

Using the real price is not the correct index to use for measuring the value of a slave's labor services in today's prices. It does, however, give an idea of what the cost of purchasing a slave was in 2009 dollars. Thus, just before the start of the Civil War, the average price of a slave in the United States was $20,000 in current dollars. There is ample evidence that there are several million of people enslaved today even though slavery is not legal anywhere in the world. There are several organizations such as Anti-Slavery International that will point out that in many places today, slaves sell for as little as (or even less than) $100!

What was the distribution of slave ownership from 1 to 2,000?

A second issue of interest is slave wealth in both micro- and macro-economic terms. Slaveholders were wealthy individuals both with respect to other Southerners and with respect to the whole country. At the time, the Census Bureau measured wealth in two forms: real estate and personal estate. The land and buildings of a slave plantation were real estate; the slaveholdings were part of personal estate. Together they sum to Total Estate (TE). On both dimensions, slaveholders were different from other Southerners. The average white Southern family in antebellum America lived on a small farm without slaves. Slave ownership was the exception, not the rule.

Table 1

| Size Distribution of Farms - 1860 for farms of 3 or more improved acres) |

||||

| acres | number | percent | cum % | cum % |

| >1000 | 5,364 | 0.27 | 100.00 | 0.27 |

| 500 - 999 | 20,319 | 1.04 | 99.73 | 1.31 |

| 100- 499 | 487,041 | 24.91 | 98.69 | 26.23 |

| 50 - 99 | 608,878 | 31.14 | 73.77 | 57.37 |

| 20 - 49 | 616,558 | 31.54 | 42.63 | 88.91 |

| 10 - 19 | 162,178 | 8.30 | 11.09 | 97.20 |

| 3 - 9 | 54,676 | 2.80 | 2.80 | 100.00 |

| Source: Soltow, table 5.1 | ||||

Let us begin by looking at land. Lee Soltow collected the data by "spin" sampling from the 1860 census.17 Following the US census, he defined a farm as involving at least 3 improved acres of land, and it should be noted that this is for farms throughout the United States, not just the South. The size distribution of farms is shown below.

"Number" is the number of farms in the interval. The stereotypical picture of slavery is that it involved a large plantation. Farms that were greater than 500 acres (and remember there are 640 acres in a square mile) comprise just 1.31 per cent of farms. The vast majority of farms were between 20 and 500 acres.

Table 2 shows that the distribution of slave ownership in Soltow's data is more skewed than land.

Table 2

| Disbribution of Slaves and Estate Value among Free Adult Males in South - 1860 |

||||

| Number of | Number | Total | ||

| slaves | slaveholders | percent | cum % | Estate |

| >1000 | 1 | 0.00005 | 100.00 | |

| 500 - 999 | 13 | 0.00065 | 100.00 | $957,000 |

| 100 - 499 | 2,278 | 0.11 | 100.00 | $160,000 |

| 50 - 99 | 8,367 | 0.42 | 99.88 | $ 72,000 |

| 10 - 49 | 97,333 | 4.89 | 99.46 | $ 17,200 |

| 5 - 10 | 89,556 | 4.50 | 94.57 | $ 8,800 |

| 1 - 4 | 187,336 | 9.41 | 90.07 | $ 3,670 |

| 0 | 1,605,116 | 80.66 | 80.66 | $ - |

| Source: Soltow (1975), table 5.3 | ||||

Over 80 percent of the free adult males in the South did not own slaves. Only 0.11 percent owned more than 100. The total estate for those in the upper tail of the distribution was enormous. It should be emphasized that this is not a small elite; as a group, slave owners were sizeable and wealthy. Those with more than 500 slaves were essentially millionaires in $1860.

Soltow calculated the Total Estate for free adult males at each of the break points in the distribution of slaves reported above. Soltow reports that the average Total Estate in the South in 1860 was $3978 as compared to just $2040 in the North.18 Given the average slave price in 1860 was $800, if Southern wealth were exclusively slaves, that amount would equate to just over 5 slaves. Total estate, however, also includes real estate, and Soltow reports that amount actually involves an average of 2 slaves. Thus, according to the table above, 90.07 percent of free adult males in the South owned fewer slaves than implied by average wealth. In 1860, the top one percent of wealth holders held 27 percent of total estate; the bottom 50 percent held but one percent of the total.

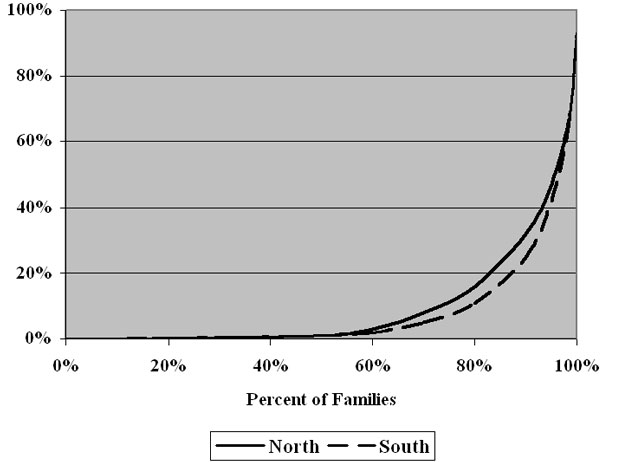

In Figure 6 below, we see how the distribution of total estate in the South compared to that in the North in 1860. The data again come from Soltow's sampling. As can be seen, there is almost no difference between the North and the South at the top of the distribution. The North is slightly above the South at the 0.001 level, but they are even at the 0.01 level. The largest planters were as wealthy as the major Northern merchants and industrialists. Between .01 and .10 levels, the South forges ahead before the North begins to close the gap. In both areas, the bottom 50% of the wealth distribution held but 1% of measured wealth. The evidence suggests that a Southern white farm family of four (a husband, wife, and two children) who owned a slave family of four had more wealth than a Northern white farm family of four that employed a couple of farm laborers. Non-slaveowners in the South were probably little different from Northern farmers. The aggregate share of the top 10% of the wealth distribution of Southern wealth is seven percentage points more than the top 10% of the Northern distribution (75% vs. 68%).

Figure 6

Wealth Distribution 1860

North vs. South

What is the comparable "value" of the wealth in slaves in today's prices?

Of the ten "measures" developed by MeasuringWorth, two are useful for discussing the value of the wealth invested in slaves. They are: economic status and economic power. We discussed the concept of economic status in relation to evaluating a slave's price above, but it is also useful for discussing wealth, as people with status are typically people of wealth.

The Economic Power.

Economic power usually connotes wealth. The people who are the financial and political leaders of a community are often its most wealthy. Even if they have not been elected to power, the wealthy often have disproportionate influence on those who do. The MeasuringWorth definition of economic power is to compare the value of something as a percent of total GDP between then and now. Thus, for example, the $500 slave price would be $1.8 million today. While this seems very large, as we will show below, the wealth tied up in slaves was a large proportion of the total wealth of the nation. Slave owners as a group had considerable economic power.19

It is interesting to note that the economic power of owning one slave was much higher earlier in the century - as high as $8 million. This is consistent with the history of the period where southern states exercised great influence on such issues as tariffs, banking and what new areas of the country would allow slavery. As the century progresses, the "power measure" of owning a single slave declines because industrialization and agriculture in North are growing faster than the slave economy.

The estates of slave owners were quite large as can be demonstrated when measured in current dollars. Table 3 shows the economic status and power of their estates in 2009 dollars.

Table 3

| Distribution of Total Estate among Slaveholders |

|||

Number of Slaves |

Total Estate (thousands of 1860 Dollars) |

Economic Status (millions of 2009 $) |

Economic Power (millions of 2009 $) |

>1000 |

NR |

- |

- |

500 - 999 |

$ 957 |

$ 319 |

$ 3,110 |

100 - 499 |

$ 160 |

$ 53 |

$ 520 |

50 - 999 |

$ 72 |

$ 24 |

$ 234 |

10 - 49 |

$ 17 |

$ 6 |

$ 55 |

5 - 10 |

$ 9 |

$ 3 |

$ 29 |

Comparing these two tables, it becomes quite clear that the holder of 10 slaves likely ranks in the top one percent of the distribution, if economic status is used as the standard of comparison. Potentially all slaveholders rank in the top one percent, if economic power is used as the standard of comparison. Clearly, the ownership of even one slave implied the owner was a wealthy member of the community. Those who owned over 500 slaves had a measure of economic power that compares to billionaires today.

IV

How much wealth was invested in slaves?

Slaves had an important impact on the differences in regional wealth. Gavin Wright made estimates of both Northern and Southern wealth. His data for 1850 and 1860 are reported in the table below. The "value of slaves" figures are taken from Sutch and Ransom (1988).20

Table 4

|

Regional Wealth in 1850 and 1860 Millions of dollars (except per capita) |

|||

|

North |

South |

North |

South |

|

1850 |

1850 |

1860 |

1860 |

Total Wealth |

$4,474 |

$2,844 |

$9,786 |

$6,332 |

Value of Slaves |

|

$1,286 |

|

$3,059 |

Non-slave Wealth |

$4,474 |

$1,559 |

$9,786 |

$3,273 |

|

|

|

|

|

Wealth (free) per capita |

$315 |

$483 |

$482 |

$868 |

Non-slave (free) Wealth per capita |

$315 |

$174 |

$482 |

$294 |

|

|

|

|

|

Source Wright (2006), p. 60. |

||||

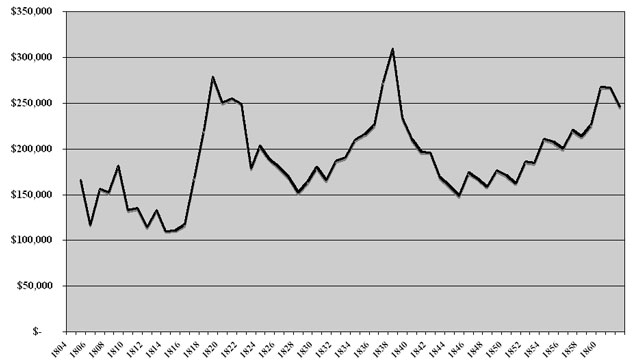

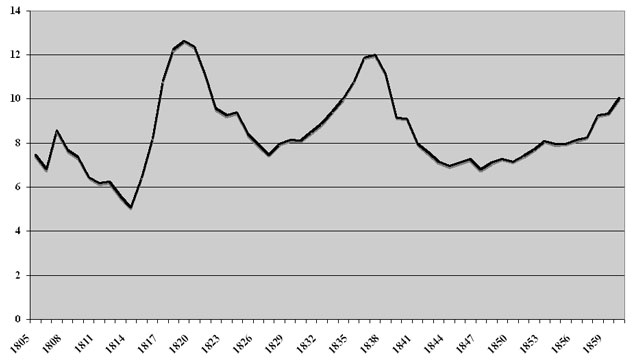

A goodly proportion of the wealth in slaves was eliminated by the stroke of Abraham Lincoln's pen when he signed the Emancipation Proclamation that freed slaves in the rebellious areas. Success on the battlefield ensured their freedom. Remember that the Emancipation Proclamation freed slaves only in areas in rebellion - not all slaves. More fundamentally, it was success on the battlefield that eliminated this wealth. Total slave wealth was immense. Figure 7 shows the aggregate value of slaves adjusted to today's prices measured using the relative share of GDP. While it varies with the price of slaves over the period, it is never less that seven trillion dollars and, at the time of Emancipation, was close to ten trillion 2009 dollars

Figure 7

Wealth in Slaves in Trillions of 2009 dollars

As Measured by the Share of the GDP

An alternative way of making that calculation is to use Soltow's finding that Total Estate in slaves was 15.9 percent of the 1860 total.22 The Federal Reserve's Flow of Funds accounts report total assets for households is about $63 trillion in 2009. If Soltow's percentage is applied to that data, the result is again approximately $10 trillion. Lest anyone think this a small number, it is roughly 70 percent of GDP today.

If Wright's figures above are adjusted to today's prices through the use of the relative share of GDP measure, they tell the same story as the table below shows.

Table 5

|

Regional Wealth in 1850 and 1860 Billions of $2009 dollars |

|||

|

North |

South |

North |

South |

|

1850 |

1850 |

1860 |

1860 |

Physical Wealth |

$24,700 |

$15,700 |

$31,800 |

$20,600 |

Value of Slaves |

- |

$7,100 |

- |

$9,900 |

Non-slave Wealth |

$24,700 |

$8,600 |

$31,800 |

$10,600 |

It should be noted that wealth grows roughly 30 percent over the decade of the 1850s in both the North and South. However, in the South, the value of slaves grew about 40 percent over the decade, while non-slave wealth grew at only about 25 percent.21 Some economic historians have hypothesized that Southerners had so much wealth tied up in slaves that they did not invest sufficiently in other types of investments. This is a concept called "crowding out." Whether that is the reason or not, it is clear at the start of Civil War, the North had three times the amount of non-slave wealth as the South and this would be at least partly represented in factories and other capital that was an advantage in waging a war.

Conclusions

Slavery in the United States was an institution that had a large impact on the economic, political and social fabric on the country. This paper gives an idea of its economic magnitude in today's values. As noted in the introduction, they can be conservatively described as large.

Appendix

The following quotes are from users of MeasuringWorth making comments about the US dollar relative value calculator.

I'm using this to calculate the cost in today's dollars for the $1,000 fine imposed by the 1850 Fugitive Slave Act. I'll be using the $26,631 CPI figure for the comparison. We are renovating a home used by a prominent York PA businessman (William C. Goodridge) for his Underground Railroad activities. This is one measure of the risk he took to help runaway slaves gain their freedom. We plan to use this information on our website and will cite your website as the source.

A slave purchased her freedom from her owner for $600 in 1794. This calculator says that equals over $11,000 today. How could a slave possibly earn that much money? This is for an academic book that's already been published, so I was asking the question just for my own information.

Thank you so much for this resource. I teach United States history in the middle school to put historical figures into perspective. When teaching about slavery, for instance, it helps students understand the Southern perspective to know that an African American slave ran about as much as a new car would today.

I teach English. I found the price for a slave back in 1830 could go up to $4000. Your calculator showed that this corresponds to almost $90,000. This would rather suggest, "care" than "kill" by the owner. The whole slavery issue seems to be presented too simplified to be true. The conflict cannot be understood.

I am writing a book on Abraham Lincoln. Lincoln estimated that in 1860 the total value of all slaves in the United States was equal to $2,000,000,000 (two billion dollars. I want to know what that equates to in today's dollars.

I am a retired physician, now occupied with reading about a variety of historical topics related to the U. S. Civil War. I am a volunteer at the Abraham Lincoln Presidential Library, Springfield, IL. A common question asked by visitors is the average cost of a slave in the South in 1860, and its equivalent in current dollars.

I am a middle school history teacher and am trying to explain to my students what it meant for a slave to be sold for $1000 in 1850. How much would that be now? I figure the CPI is the one that shows the data I need, but it is confusing to figure out which one fits my needs even with the descriptions. A person with limited economics background is left unsure.

When my father was researching his family's genealogy, he came upon an ancestor's will, which mentioned the dispositions of his 3 slaves. The adult male was first to be offered to his family if they could buy him for $700; otherwise he was to be sold at auction. No later mention was made of the slave and I don't know what happened to him. This was shocking to me. I know many people must have slave-owning ancestors, but to have actual documentation of this in my family, no matter how far back, was repulsive. I know this was a huge amount of money in pre-Civil War times, in the 1840's-50's, and I wanted to know the equivalent amount today. I am not sure which indicator I want to use or what I intend to do with the information.

I am dealing with history: During the Civil War slave owners were paid $300.00 per slave in order to "release" them so they could serve in the Union Army. I know that in 1864 $300 was a lot of money; I am interested in understanding what that amount would represent today - in 2010.

I am researching compensation claims made after the Civil War of slaveholders loyal to the Union claiming compensation for the "value" of the slave, if said slave served in the Union army.

I was checking the cost of a prime field hand slave just before the American Civil War started, to see just how much of an investment one was at the time.

Bibliography

Carter, Susan B., Scott Sigmund Gartner, Michael R. Haines, Alan L. Olmstead, Richard Sutch and Gavin Wright, editors, Historical Statistics of the United States: earliest times to the present (New York: Cambridge University Press, 2006).

Conrad, Alfred, and John Meyer. "The Economics of Slavery in the Antebellum South." Journal of Political Economy, vol. 66, no. 2, April 1958.

David, Paul, Herbert Gutman, Richard Sutch, Peter Temin, and Gavin Wright. Reckoning with Slavery: A Critical Study in the Quantitative History of American Slavery. New York: Oxford University Press, 1976.

Fogel, Robert William. "A Comparison between the Value of Slave Capital in the Share of Total British Wealth (c.1811) and in the Share of Total Southern Wealth (c.1860)," chapter 56 of Robert William Fogel, Ralph A. Galantine, and Richard L. Manning, Without Consent or Contract: Evidence and Methods. New York: Norton, 1992.

Fogel, Robert William. Without Consent or Contract: The Rise and Fall of American Slavery. New York: W. W. Norton, 1989. Fogel, Robert William, and Stanley Engerman. Time on the Cross: The Economics of American Negro Slavery, 2 vols. Boston: Little, Brown, 1974.

Gray, Lewis Cecil, History of Agriculture in the Southern United States to 1860. Baltimore: Waverly Press, 1933, p. 566

Kotlikoff, Laurence J. "Quantitative Description of the New Orleans Slave Market, 1804 to 1862," chapter 3 of Robert William Fogel and Stanley L. Engerman, Without Consent or Contract: Markets and Production: Technical Papers, Volume 1 (New York: Norton, 1992), reprinted from Economic Inquiry, vol. 17, no. 4, October 1979.

Officer, Lawrence H. "What Was the Value of the US Consumer Bundle Then?" MeasuringWorth, 2009a. URL: http://www.measuringworth.org/consumer/

Officer, Lawrence H. "The Annual Consumer Price Index for the United States, 1774-2009," MeasuringWorth, 2009b. URL: http://www.measuringworth.org/uscpi/

Officer, Lawrence H., and Samuel H. Williamson, "Measures of Worth," MeasuringWorth, 2008. URL http://www.measuringworth.com/worthmeasures.html

Olmstead, Alan, and Paul Rhode, Creating Abundance: Biological Innovation and American Agricultural Development. New York, Cambridge University Press, 2008.

Ransom, Roger and Richard Sutch, "Capitalists without Capital: The Burden of Slavery and the Impact of Emancipation," Agricultural History 62 (3) (1988)

Soltow, Lee, Men and Wealth in the United States 1850-1870 (New Haven: Yale University Press, 1975).

Wright, Gavin. Slavery and American Economic Development. Baton Rouge: Louisiana State University Press, 2006.

* The authors thank Stanley Engerman, Richard Sutch, Gavin Wright, and Robert Whaples for their comments on a previous draft as well as participants in the Northern Illinois University Economics workshop and the 2010 All-UC conference.

Back to text

1 Susan B. Carter, Scott Sigmund Gartner, Michael R. Haines, Alan L. Olmstead, Richard Sutch and Gavin Wright, editors, Historical Statistics of the United States: earliest times to the present (New York: Cambridge University Press, 2006), series Bb212.

Back to text

2 Between 1804 and 1862, 135,000 slaves were sold on the New Orleans market. Kotlikoff, "Quantitative Description of the New Orleans Slave Market, 1804 to 1862" (1979)

Back to text

3 These costs are an obligation of the slave owner even when the slave is too young, old or infirm to work. There is ample evidence that these slaves who were not productive did not receive as much food as the able bodied, but there is no evidence that they were allowed to starve.

Back to text

4 See Robert William Fogel, Without Consent or Contract: The Rise and Fall of American Slavery (New York: W. W. Norton, 1989), Chapter 3.

Back to text

5 Present value is the value today of a series of payments, or a single payment, that will be received in the future. Money put in a bank or alternative investment today will grow over time depending on the interest rate. What is received in the future is principle plus interest. Present value calculations determine the amount of principle that is needed today in order to realize a given series of payments in the future.

Back to text

6 The main reason that New South Slaves had higher prices was that the soil was more fertile there, so plantations were more productive. See Alan Olmstead and Paul Rhode, Creating Abundance: Biological Innovation and American Agricultural Development. New York, Cambridge University Press, 2008.

Back to text

7 See Fogel, op. cit., pp. 69-70.

Back to text

8 Of course, the number had different meaning to the slave. However, as there were cases where slaves bought their own freedom, the opportunity cost question is the same.

Back to text

9 Lawrence H. Officer and Samuel H. Williamson, "Measures of Worth," MeasuringWorth, 2008. URL: http://www.measuringworth.com/worthmeasures.html

Back to text

10 A fourth measure, economic power, is used in our discussion of the magnitude of the wealth represented by the ownership of slaves.

Back to text

11 In his famous history of Agriculture in the Southern United States to 1860, published in 1933, Lewis Gray writes "Planters preferred to employ their own slaves - rather than hire them to others.

Because of the scarcity of efficient white labor, demand for Negro artisans was usually considerable, and good wages were offered for their services. Unskilled labor was in demand for lumbering, mining, the constructions of canals and railways, steamboating, dock labor, and other 'public works.'" p. 566

Back to text

12 Unskilled workers today are those who have less than a high school education.

Back to text

13 Lewis Gray, op. cit, p. 566

Back to text

14 While it might be better to make the comparisons using average wealth then and now, those numbers are not available. There is evidence, however, that wealth and income are closely related and move up and down together.

Back to text

15 See Lawrence Officer, "What Was the Value of the US Consumer Bundle Then?" MeasuringWorth, 2009a,and Offficer, "The Annual Consumer Price Index for the United States, 1774-2009," MeasuringWorth, 2009b.

Back to text

16 Today the share of food and beverages of the average household is 15% and most of the cost of housing is to maintain a residence that is owned.

Back to text

17 Lee Soltow, Men and Wealth in the United States 1850-1870 (New Haven: Yale University Press, 1975).

Back to text

18 Soltow, op. cit., p. 181.

Back to text

19 To understand how MeasuringWorth distinguishes between economic status and economic power, consider two economies. In the first economy there are 999 people who have $10,000 in wealth and a rich person who has $250,000. The rich person has great "status" over the rest, but his or her wealth is only two and a half percent of the total. In the second economy there are people, 49 people who have $10,000 in wealth and a rich person with $250,000. The rich person owns a third of all the wealth in this economy. In both cases the rich person is 25 more wealthy than the rest of the society, but in the second case he or she controls 13 times more of the total and has much more economic power.

Back to text

20 That amount of wealth in slave was calculate by Roger Ransom and Richard Sutch as the product of a three-year moving average of slave prices and the size of the slave population.

Back to text

21 Most economic historians feel the slave prices in 1860 were artificially high for a variety of reasons and that even without the War, they would have fallen, so these comparisons of wealth somewhat overstate the wealth of the South at the time.

Back to text

22 The percent figure was calculated by Fogel from Soltow: Robert W. Fogel, "A Comparison between the Value of Slave Capital in the Share of Total British Wealth (c.1811) and in the Share of Total Southern Wealth (c.1860)," chapter 56 of Robert William Fogel, Ralph A. Galantine, and Richard L. Manning, Without Consent or Contract: Evidence and Methods (New York: Norton, 1992.

Back to text

Please let us know if and how this discussion has assisted you in using our calculators.